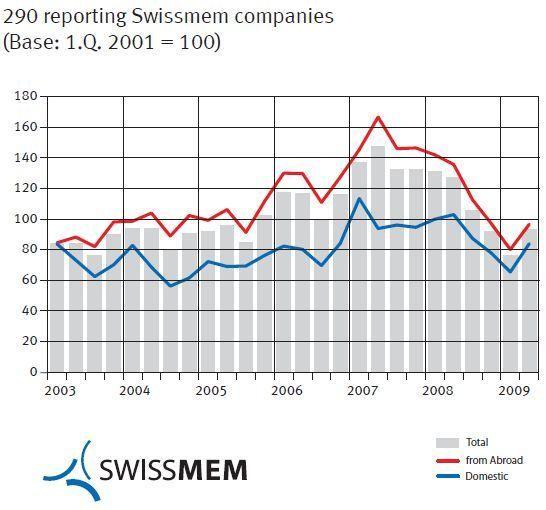

Sales by Swissmem's 290 reporting members fell by a total of 19.1% in the first half of 2009. Compared to sales in 2008, there was a greater drop in the second quarter of this year (-22.7%) than in the first quarter (-15.1%). Alongside foreign business (-19.5%), which accounts for almost four-fifths of sales, domestic business (-17.2%) also contributed to the negative trend. The slump in new orders slowed during the first half of 2009. While new orders in the first quarter of 2009 were down 41.8% year on year, the difference in the second quarter was -26.6%. The slump in new orders from abroad (-36.4%) was accompanied by a large drop in domestic demand (-26.3%). Business results for the first half year were unsatisfactory in all subsectors. Metalworking (-37.5%) and mechanical engineering (27.4%) suffered particularly large decreases in exports. The subsectors of electronics and electrical engineering (-19.2%) and automotive (-13.5%) also posted much lower exports than last year. The smallest difference to last year’s performance was in precision instruments, with a drop of 5.1%. In total, the MEM industries' exports in the first half of 2009 amounted to CHF 31.4 billion, or 23.0% lower than in the previous year. All sales markets hit hard A negative impact was felt in particular in the main sales markets. Exports to the Western European markets, which purchase two thirds of all goods exported by the Swiss MEM industries, were down by 25.5% on 2008. The decline in neighbouring countries Germany (27.0%), France (-30.7%) and Italy (-32.9%) was only softened slightly by exports to other regions. 15.6% fewer goods were exported to the Asian markets (which, with a market share of around 17%, make up the second most important sales region), while exports to the US fell by 22.7%. Job cuts and restructuring unavoidable The weak state of the economy overall, and falling capacity utilization in industry (79.4% in Q2 2009) have made various restructuring measures and the introduction of short-time work necessary. After an increase of around 50,000 full-time positions in recent years, the number of persons working in the MEM industries has fallen by 10,419 over the past year, and stood at 338,355 FTEs at the end of June. The number of employees has thus fallen back to 2007’s level. Swissmem supports the extension of short-time work to 24 months If the Swiss Government estimates the unemployment rate to be 5.5%, it is right to take measures in the labour market, particularly to help combat unemployment among young people, which is rife. The measures planned under the third stabilization project are capable of at least partially reducing the collapse in jobs. It should be viewed positively that these measures will allow those affected by unemployment to keep in touch with the labour market, and will ensure their unemployment benefits are not exhausted as rapidly. However, Swissmem takes a critical stance on financial aid for temporary positions in NPOs. Swissmem also supports the extension of short-time work from 18 to 24 months. In a normal recession, it would be questionable to again prolong the maximum period of short-term work, owing to the related structural risks. However, these risks are low in the current recession. For this reason, extending the maximum short-time work period will provide companies that are otherwise healthy but just have no orders, as no one has any orders to place, with an opportunity to save their employees and thus keep expertise within the company and enter into a better future. Swissmem therefore calls for a decision to be made quickly concerning the necessary change in legislation. Talks with the banks continue For the purposes of advance planning, Swissmem launched two ideas at the end of May that could be put into action, should liquidity bottlenecks occur: an increase in guarantee limits, and the establishing of a type of bridging fund. Talks with the banks in this regard are still underway. At the last set of talks at the end of last week, we discussed various possible solutions and have decided to flesh these out. We have agreed to only inform the press again once we have actual results to show. Zurich, 1 September 2009 For further information, please contact: Ruedi Christen, Head of Communications E-mail: r.christen@swissmem.ch Tel.: +41 (0)44 384 48 50 / Mobile: +41 (0)79 317 24 09